Comprehending Offshore Count On Property Security: Services to Secure Your Assets

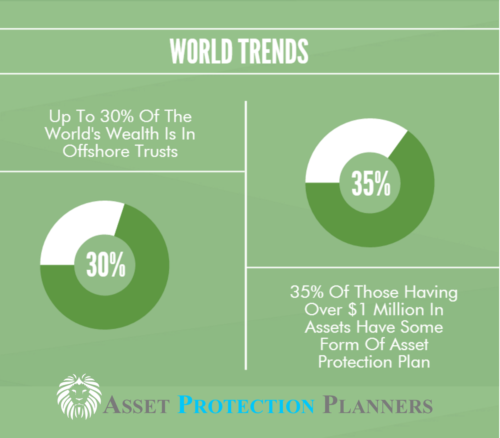

If you're looking to secure your riches, recognizing offshore depend on property security is vital. These counts on can give an efficient shield versus creditors and lawful cases, guaranteeing your possessions remain safe.

What Is an Offshore Count On?

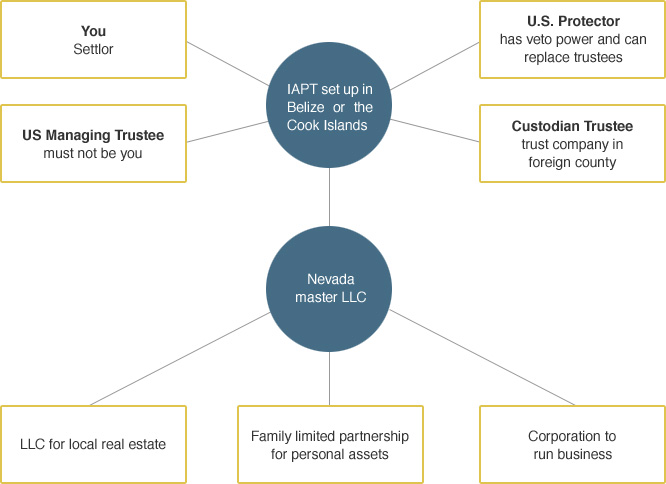

An offshore depend on is a legal setup where you position your properties in a count on managed outdoors your home nation. This configuration enables you to separate your assets from your individual estate, giving an additional layer of management and defense. When you establish an offshore count on, you designate a trustee who looks after the possessions according to your specified terms. This can aid you keep control while gaining from the advantages supplied by the territory where the count on is developed.

You can pick numerous kinds of offshore counts on, such as discretionary or set depends on, based on your financial objectives. Additionally, you can designate recipients that will certainly receive the trust's possessions in the future. Offshore counts on can also supply personal privacy, as they commonly protect your financial details from public examination. Overall, recognizing exactly how an offshore trust functions empowers you to make informed choices about guarding your wealth properly.

Advantages of Offshore Trusts for Possession Security

One more substantial benefit is tax effectiveness. Depending upon the jurisdiction, you may take advantage of positive tax obligation treatments, which can assist you protect more of your wealth. Offshore trusts can also offer adaptability regarding property monitoring and circulation, permitting you to customize the depend your certain requirements and goals.

Kinds Of Offshore Counts On

When thinking about offshore trusts, you'll come across various types, primarily revocable and irreversible depends on. Each serves different purposes and provides distinctive degrees of property security. Furthermore, recognizing optional and non-discretionary trusts is crucial for making educated choices concerning your estate preparation.

Revocable vs. Irrevocable Trust Funds

Understanding the distinctions between revocable and irreversible trusts is crucial for any individual considering overseas asset defense. A revocable trust permits you to maintain control over the possessions, allowing you to customize or liquify it anytime.

On the other hand, an irrevocable trust fund eliminates your control when established, making it much more secure from lenders. You can't alter or revoke it without the approval of the recipients, which offers more powerful property defense. Picking between these kinds depends upon your monetary objectives and run the risk of resistance, so evaluate the advantages and disadvantages meticulously prior to choosing.

Optional vs. Non-Discretionary Counts On

Optional and non-discretionary trust funds offer various purposes in offshore possession defense, and recognizing which type fits your needs can make a substantial distinction. In an optional trust, the trustee has the versatility to make a decision just how and when to disperse properties to beneficiaries. This can offer higher security from creditors, as beneficiaries don't have ensured access to funds. On the other hand, a non-discretionary depend on calls for the trustee to stick purely to determined terms, making certain recipients obtain specific distributions. While non-discretionary trusts offer predictability, they may expose assets to claims in certain situations. Ultimately, comprehending these distinctions aids you customize your overseas trust technique to properly protect your possessions and accomplish your monetary objectives.

Trick Solutions Provided by Offshore Trust Companies

Many offshore trust fund suppliers offer a series of important solutions developed to shield your assets and assurance compliance with worldwide regulations. One crucial solution is asset monitoring, where professionals manage your investments to make the most of returns while minimizing threats. They likewise provide depend on administration, ensuring your trust fund runs efficiently and sticks to lawful demands.

Tax preparation is another critical service, aiding you enhance your tax obligation circumstance and prevent unneeded liabilities. In addition, these providers often use estate planning aid, directing you in structuring your count on to satisfy your lasting objectives and safeguard your legacy.

Finally, numerous offer reporting and compliance services, ensuring you meet annual filing requirements and maintain transparency with regulatory bodies. By benefiting from these services, you can enhance the protection of your assets and achieve assurance knowing that your financial future remains in qualified hands.

Picking the Right Territory for Your Offshore Trust Fund

When picking the appropriate territory for your overseas trust, you require to ponder the asset defense laws, tax effects, and the total credibility of the area. Each jurisdiction offers distinct benefits and difficulties that can considerably affect your depend on's performance. By recognizing these variables, you can make an extra enlightened choice that aligns with your financial objectives.

Administrative Possession Protection Rules

Selecting the best visit this site territory for your offshore trust is important, as it can greatly influence the level of property security you receive. Various jurisdictions have differing asset defense legislations, which can shield your possessions from lenders and legal cases. Search for nations with strong lawful frameworks that focus on trust personal privacy and offer positive guidelines. Consider territories understood for their robust economic systems, like the Cayman Islands or Nevis, as they provide a solid lawful foundation for asset security. Verify the picked location has laws that protect against required heirship insurance claims and impose limitations on financial institutions. By thoroughly investigating and selecting the appropriate jurisdiction, you can enhance the safety of your properties and take pleasure in tranquility of mind.

Tax Obligation Implications and Advantages

Just how can recognizing tax ramifications enhance the advantages of your overseas trust? By picking the ideal jurisdiction, you can potentially decrease your tax obligation obligation and optimize your property security. offshore trusts asset protection. Some offshore locations supply beneficial tax rates or perhaps tax exemptions for depends on, allowing your properties to grow without heavy taxation

Furthermore, comprehending neighborhood tax obligation legislations can aid you structure your depend on successfully. You'll wish to think about just how income created by the trust is taxed and recognize any type of coverage demands.

Legal Security and Reputation

As you discover choices for your overseas count on, recognizing the legal security and reputation of potential territories is essential. A jurisdiction with a solid lawful framework warranties your assets are protected and much less at risk to political Learn More Here or financial instability. Examine the country's laws pertaining to property security and depend on monitoring; some territories offer desirable regulations, while others might have limiting techniques.

Online reputation matters also. Try to find well-regarded jurisdictions recognized for their transparency, security, and strong financial systems. Study exactly how these nations deal with global cooperation and compliance with worldwide guidelines. This diligence will certainly aid you choose an area that not just safeguards your assets however likewise supplies assurance for the future. Ultimately, an audio selection enhances your trust's efficiency and safety.

Lawful Considerations and Conformity

While developing an offshore count on can provide considerable possession defense benefits, it's crucial to browse the intricate legal landscape with treatment. You'll need to understand the legislations regulating counts on in both your home country and the jurisdiction where the count on is developed. Compliance with tax obligation policies is very important, as stopping working to report offshore accounts can bring about serious penalties.

Furthermore, you ought to recognize worldwide treaties and arrangements that may influence your depend on's procedures. Each country has distinct demands for documentation, reporting, and administration, so you'll desire to seek advice from with lawful and financial advisors experienced in overseas trusts.

Staying compliant isn't just about staying clear of legal troubles; it also guarantees that your possessions are secured according to the regulation. By focusing on legal factors to consider and compliance, you protect your riches and keep assurance as you browse this elaborate procedure.

Actions to Establishing an Offshore Trust

Establishing an overseas trust involves several crucial actions that can aid simplify the process and ensure your properties are legally safeguarded. You'll require to pick a trustworthy territory that uses desirable regulations for possession defense. Research study different nations and think about variables like tax obligation ramifications and legal stability.

Next, select a reliable trustee. This could be a financial organization or a private knowledgeable in taking care of trusts. Make certain they understand your objectives and can abide by local policies.

Once you have actually selected a trustee, you'll draft the depend on file. This must information your purposes and define Visit Website beneficiaries, assets, and distribution approaches. Consulting with a lawful specialist is important to make sure your record satisfies all requirements.

Regularly Asked Concerns

Can I Establish an Offshore Depend On Without an Economic Consultant?

You can establish an offshore trust fund without a financial advisor, however it's risky. You may miss essential lawful demands or tax effects. Research completely, and consider seeking advice from professionals to ensure everything's done properly.

Just how much Does It Expense to Maintain an Offshore Trust Fund Annually?

Preserving an offshore count on annually can cost you anywhere from a few hundred to a number of thousand dollars. Factors like territory, complexity, and trustee fees affect these expenses, so it's smart to spending plan as necessary.

Are Offshore Counts On Only for Wealthy Individuals?

Offshore trust funds aren't simply for affluent individuals; they can profit anybody seeking to shield properties or prepare for the future. They supply privacy and versatility, making them available for a more comprehensive variety of economic circumstances.

What Happens if I Modification My Mind Concerning the Trust Fund?

If you transform your mind regarding the count on, you can commonly customize or revoke it, depending upon the trust's terms. offshore trusts asset protection. Seek advice from with your lawyer to assure you adhere to the right lawful treatments for changes

Can I Access My Assets in an Offshore Trust Fund any time?

You can't access your possessions in an overseas trust any time. Typically, these counts on restrict your control to shield properties. You'll require to adhere to the depend on's guidelines to access funds or residential or commercial property.

Final thought

To sum up, comprehending offshore count on possession security can be a game-changer for safeguarding your wide range. Remember, establishing an offshore depend on isn't simply concerning protection; it's concerning ensuring your monetary future is safe.